|

Dumas Co-op Elevators

Patron Access

**Cash Bids**

Market Data

News

Ag Commentary

Weather

Resources

|

This Dividend Stock Is Up 10% This Year and Amazon Could Take It Even Higher

News broke just days ago that Amazon (AMZN), the world’s largest online retailer and leader in logistics, has taken another significant step in its efforts to become more sustainable. As part of a pilot program, Amazon is now testing a fleet of BrightDrop electric delivery vans, joining its existing mix of Rivian (RIVN), Ford (F), and Mercedes-Benz vehicles (MBGYY). With a groundbreaking $1 billion investment to electrify its European transportation network, Amazon regularly evaluates various models to expand its electric fleet and refine its delivery strategy. Currently, a dozen BrightDrop vans are under review as Amazon explores further options for greener deliveries. This pilot is drawing new attention to General Motors (GM), the maker of BrightDrop and currently a favorite among dividend stock investors. GM’s forward dividend yield stands at 1.02%, offering consistent income to shareholders. Notably, GM sold over 19,000 electric vehicles in July 2025, an impressive 115% jump year-over-year (YoY). The stock itself has gained 4.9% in the past month, attracting more interest as GM works to strengthen its EV offerings and secure strategic partnerships. Could Amazon’s involvement help unlock even greater gains for GM? Let’s dive in. General Motors’ Strong NumbersGeneral Motors engineers and manufactures vehicles across the Chevrolet, GMC, Cadillac, and Buick brands, serving millions in personal, commercial, and emerging electric segments. The company rewards shareholders with a steady annual dividend rate of $0.54 and a yield of 0.92%. Looking ahead, the forward annual dividend rate is projected at $0.60, with an enhanced forward yield of 1.02%. Year to date (YTD), GM has climbed 10.89%, showing strength since Dec. 31, 2024, as the stock has gained 24.31% over the past 52 weeks and trades at $58.86.

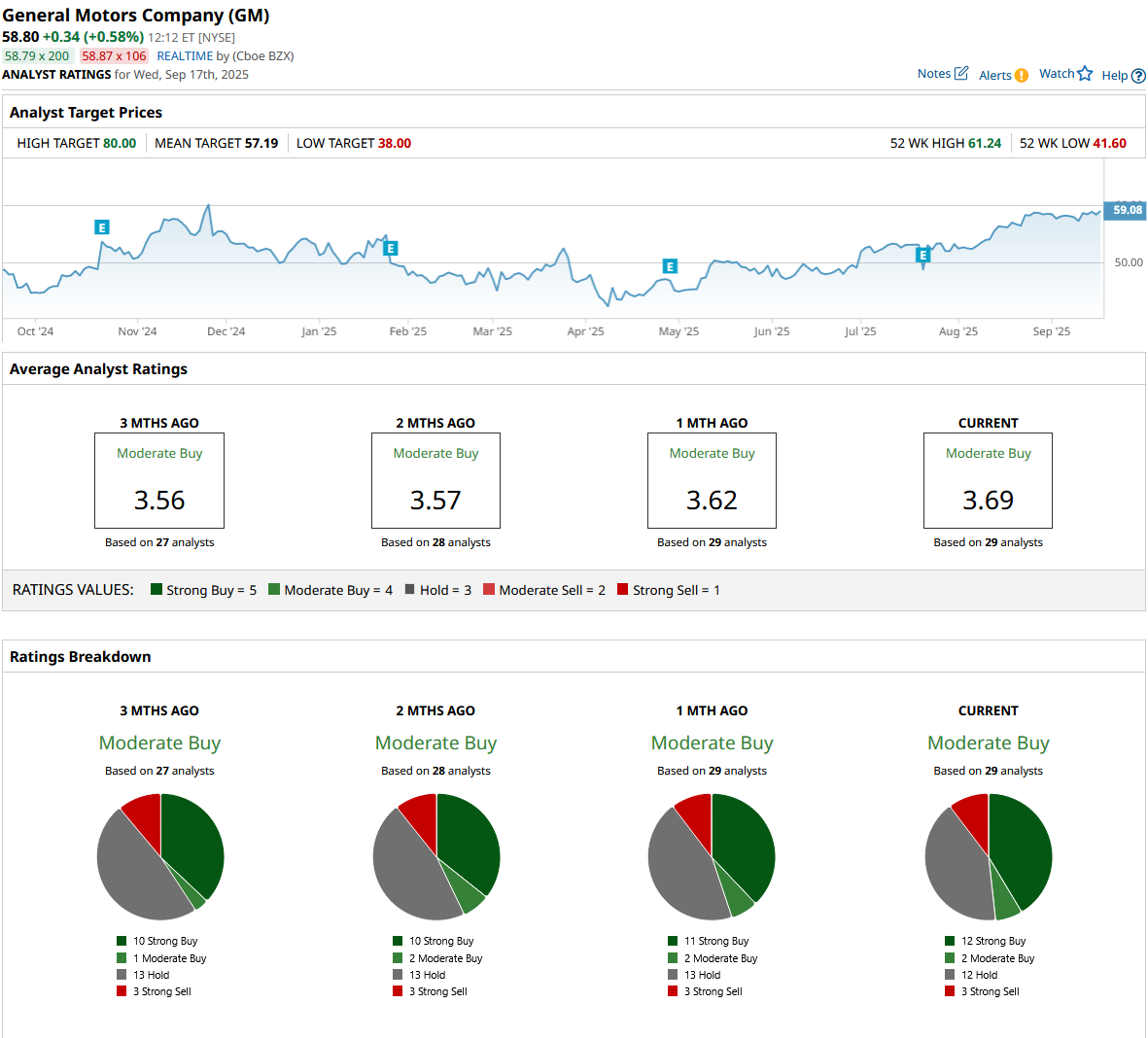

The automaker stands out with a market capitalization of $55.7 billion, and its price-to-earnings (P/E) ratio of 5.74x and forward P/E of 6.22x are well below the sector median of 17.04x and 18.14x, respectively. These lower valuation multiples suggest GM offers more for each investor dollar. July 22, 2025, brought the latest earnings report. General Motors reported second-quarter revenue of $47.1 billion. This exceeded analyst forecasts despite a 1.8% drop YoY. The company recorded net income of $1.9 billion for the period, highlighting its ability to remain profitable even in challenging environments. GM delivered EBIT-adjusted earnings of $3.0 billion, which speaks to the strength of its core operations and disciplined cost structure. This performance resulted in adjusted earnings per share (EPS) of $2.53, beating consensus estimates by 5.9% and extending GM’s run of outperformance. That decline in net income, down 29.8% from last year, reflects a $1.1 billion impact from net tariffs and ongoing investments in electric vehicle launches and manufacturing expansion. GM’s capital allocation in 2025 is aggressive but purposeful. The company recently completed a $2 billion accelerated share repurchase, retiring ten million more shares in the second quarter. This brings the total shares bought back through the program to forty-three million GM’s Future Growth TrajectoryGM is setting the stage for impressive future growth, anchored by several high-impact partnerships and investments. This year, the company joined forces with Nvidia (NVDA), aiming to transform automotive manufacturing and vehicles with artificial intelligence tools and virtual factory simulations. GM will build custom AI systems using Nvidia’s accelerated platforms, including Omniverse and Cosmos, training advanced models for factory planning, robotics, and next-gen vehicle design. GM continues to strengthen alliances outside of core automotive ventures. In June, Malibu Boats (MBUU) extended its long-standing partnership, naming Chevrolet the Official Vehicle Brand and deepening exclusive collaboration with GM Marine. Malibu will vertically integrate GM’s Monsoon engine line at its Loudon, Tennessee factory, reinforcing how GM’s technology powers the best-selling wakeboats on the market. That relationship reflects how GM’s innovation is recognized beyond traditional automaking circles. GM recently announced a plan to invest $4 billion in U.S. manufacturing plants over two years, targeting increased capacity for gas and electric vehicles. This investment will boost output to over two million vehicles annually and includes an $888 million commitment in Tonawanda, New York, for next-generation V-8 engines. These strategic investments, backed by industry-leading partnerships, signal a clear intent to move forward at scale and speed. Where GM Is Headed NextGeneral Motors is already gearing up for its next big update. The company is set to release its next earnings on Oct. 28, 2025, making it an important date for investors keeping a close watch. The current quarter’s consensus estimate stands at $2.32 per share, compared to last year's $2.96. That marks a noticeable step down, with a YoY decline of 21.62%. Analysts see full-year EPS for 2025 coming in at $9.44, a 10.94% decrease from the prior year's $10.60. Estimates for 2026 look slightly better, with an average EPS of $9.66 and a forecasted growth rate of 2.33% over 2025. The company confirmed its full-year financial guidance is unchanged, showing confidence in its ability to deliver stable results despite headwinds. The consensus of the 29 analysts who cover GM is “Moderate Buy.” The mean price target sits at $57.19, with a 2.7% downside from current levels. GM has put up solid numbers and momentum all year, and new partnerships could keep the growth going. The mix of consistent dividends, big EV ambitions, and expert moves like Amazon’s fleet test makes it a stock worth watching. Earnings estimates hint at moderation ahead, but analysts are staying fairly upbeat, with most still leaning “Moderate Buy.” Short-term price targets suggest GM may remain stable or even nudge higher, especially with fresh innovation at its back. Looking ahead, shares are most likely to hold these gains or trend up slowly as new deals and tech investments play out.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|